Considering an international master’s degree?

You’re in the right place to find information on applications, dealing with foreign study challenges, and – of course – figuring out how to finance your international education.

We know international education isn’t always a smooth path. Just studying for the GMAT, GRE, LSAT, or TOEFL is time-consuming and sometimes tricky. We aim to provide you with resources to help you succeed. But, assisting international students to fund their grad school degrees remains at the core of Prodigy Finance’s operation.

Why?

If you’re like the majority of Prodigy Finance-funded students, you don’t have many options when it comes to paying for your international master's degree.

Whether your school directed you to our site or you’ve done the research on your own, this is what you need to know now about Prodigy Finance education loans.

Prodigy Finance education loans

The belief that funding shouldn’t be a barrier to education is at the core of Prodigy finance’s operations.

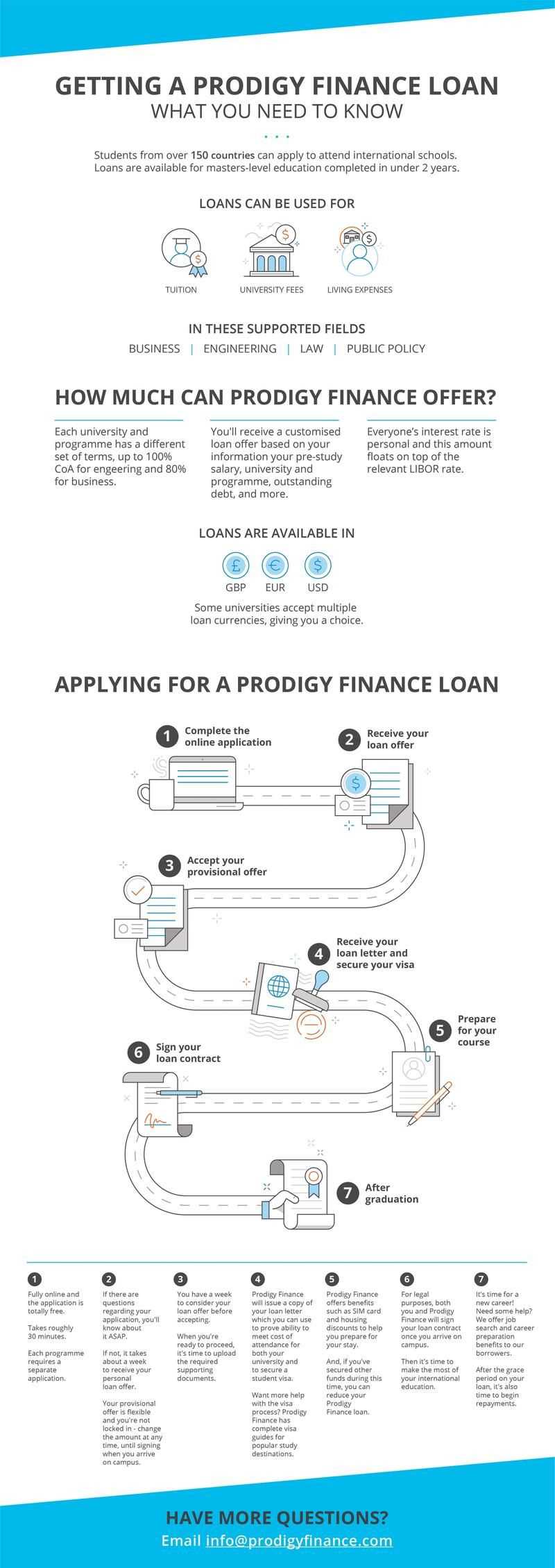

Prodigy Finance provides loans for international grad students pursuing masters in business, engineering, law, and public policy degrees.

What schools & Universities do you support?

Prodigy Finance supports about 850 schools in over 18 different countries.

Not every programme is supported at every university; you’ll need to check both the university and your course of study.

Our school search page will help you find if we support the college and course you are interested in, or can help you explore all the schools we support.

Prodigy Finance education loans - How much can we offer?

Each university and programme has a different set of terms for the acceptance of Prodigy Finance loans. Some allow these finances to cover only tuition; others permit as much as the full cost of attendance (tuition plus living expenses). Check your programme’s parameters before applying for your Prodigy loan to ensure you can cover the complete cost of your education.

In addition to university agreements, personal loan amounts are linked to pre-study salary, university and programme, outstanding liabilities and debt, countries of residence and nationality, and more.

Everyone’s Prodigy Finance education loan interest rate is personal and based on a range of factors, including credit history. This amount is floated on top of the relevant LIBOR rate as the standard base.LIBOR rates are variable and updated monthly. Interest and APR rates can be difficult to understand; watch this video or ask for a deeper explanation from our service team.

While Prodigy Finance looks at your previous salary, the amount offered is based on your potential earnings post-graduation. This usually allows for a higher loan offer than local banks can provide.

Applying for a Prodigy Finance student loan doesn’t mean you must accept an offer. And, there’s no cost to apply.

What's the Prodigy Finance application process like?

Prodigy Finance aims to help students fund their master’s education with a simple online process. The typical prodigy loan application process consists of:

- Finding your school - Make sure we support the school and the specific programme you are interested in.

- Details about the school & prodigy’s support for your programme - Get the details of Prodigy Finance’s support for the school. Check out all the important details like the maximum & minimum loan amount, cost estimates, etc. for the selected programme.

- Register & Apply - Let us know you are interested in clicking the “Apply now” button. It will redirect you to the simple registration page where you can sign up and apply for the loan.

- Start the application - Fill in your details - personal, residential, academic, finance & budgeting, and related to the course.

- Submit the application - Once you have provided all the required information for processing your loan application.

Why should I apply for a student loan with Prodigy Finance?

You can apply for a Prodigy student loan from anywhere in the world. Well, anywhere you have a secure internet connection. The process is facilitated online, and hard copies of documents aren’t required.

The processing teams work with students from around the world every day. They’re quite adept at understanding documentation differences and pointing you in the right direction.

Once you receive a provisional loan offer, you’ll be asked to upload supporting documentation.

You will need to obtain a credit report and pass a background check against Know Your Customer (KYC), Anti Money Laundering (AML) and Politically Exposed Persons (PEP) criteria.

You'll create a login to the Prodigy Finance dashboard which will guide you through the process. Our operations team will reach out, and you'll have a direct contact for any questions you may have.

Students pursuing a 2-year degree will apply for a loan for the first year and pre-approval for a loan for the second year in one go. You'll need to reapply for a loan for your second year to account for any financial changes which occurred during the first year even if you have pre-approval.

Who can apply for Prodigy Finance student loans?

Prodigy Finance loans are available to students from roughly 150 countries. Students from the UK can also apply for loans for study in the UK.

It's no longer necessary to have an acceptance letter to apply for Prodigy Finance student loans. Acceptance is, of course, necessary to complete the process and receive a loan.

Applicants may undertake loan applications for multiple universities and programmes to receive preliminary terms to determine the best path.

Funds can be used for study in business, engineering, computer science, law, public policy, economics, science, and maths at universities accepting Prodigy Finance loans. Not every programme is supported at every university; you’ll need to check both the university and your course of study. You can see if we support the school you want to study at by reviewing this Prodigy Finance list of schools.

What requirements are there to get a loan from Prodigy Finance?

To successfully apply for a student loan to cover your study abroad journey, you’ll need to satisfy the following three criteria:

You must be admitted to a school and programme we support.

You can explore our supported schools on our website.

Remember, you can apply for a quote before you have an admittance letter - we'll only ask for proof of admission when we finalize your loan and prepare for the credit report later. If you are unable to locate your school on our list, we’d love to help you fund your masters abroad, so please submit a schools request form with details of the school and course you’re interested in.

You must be looking to study abroad

You must come from one of the countries we support.

You can find a list of countries we can't support here.

Find out why these international MS students chose Prodigy Finance to fund their degrees:

What happens after accepting a Prodigy Finance education loan?

You are required to e-sign your final loan acceptance letter upon arrival at your university; your loan cannot be finalised without completing this step.

Prodigy Finance disperses loans directly to the university. If there are excesses in your account, that’s between you and the financial departments at your school.

Prodigy Finance will issue you with an official Loan Letter (known as a sanction letter in some countries). This document is required by American universities to secure the I-20 form which must be secured before applying for a visa. Universities in other countries may also request a copy and it's required to secure international study visas for most countries - and usually must be presented at immigration.

Interest begins accruing when your funds are released to your university. In addition, interest is only calculated on the principal balance of your loan account.

Unless you are attending part-time, you will have a grace period until after graduation.

However, you can make payments if you like. There’s no penalty for early repayment – and extra payments will reduce the interest paid in the long term.

What else should you know about Prodigy Finance education loans?

Prodigy Finance’s student loans are collectively funded by a community of alumni, institutional investors and qualified private investors who receive both a financial and social return.

We provide some information about our borrowers to these investors including repayment status. This transparency means your name and career act as your collateral and cosigner.

Want more student stories to warm your heart?

Which schools or universities does Prodigy Finance support?

Prodigy finance supports most of the best-ranked universities for Masters in engineering or business. Check out if your school is supported.

I need a loan sanction letter for my visa processing, as a part of the proof of funds. When can I get it?

Once your application is processed, your loan is approved, and you accept, you will be issued with a loan confirmation letter from Prodigy Finance loan letter which can act as a financial document for your visa and college application process.

Ready to get a Prodigy Finance loan?

Our collateral-free loans can help you fulfil your dreams of studying abroad.

Some of the business schools that we support:

- Alfred University: College of Business

- American University: Kogod School of Business

- Arizona State University: Carey School of Business

- Baylor University: Hankamer School of Business

- Brandeis University: Brandeis International Business School

Some of the engineering schools that we support:

- Arizona State University: Ira A. Fulton Schools of Engineering

- Florida Atlantic University: College of Engineering & Computer Science

- Illinois Institute of Technology: Armour College of Engineering

- Duke University: Pratt School of Engineering

- Pace University: Seidenberg School of Computer Science & Information Systems

Some other schools and universities that we support

- Brandeis University: The Heller School of Social Policy and Management

- Kent State University: College of Arts and Sciences

- Michigan Technological University: College of Sciences and Arts

- New Jersey Institute of Technology: College of Science and Liberal Arts

- Saint Louis University: College of Arts and Sciences

For any other information about Prodigy Finance, or our student loan process, feel free to check out or browse our site, or register for a webinar to have your questions answered by one of our customer care team.