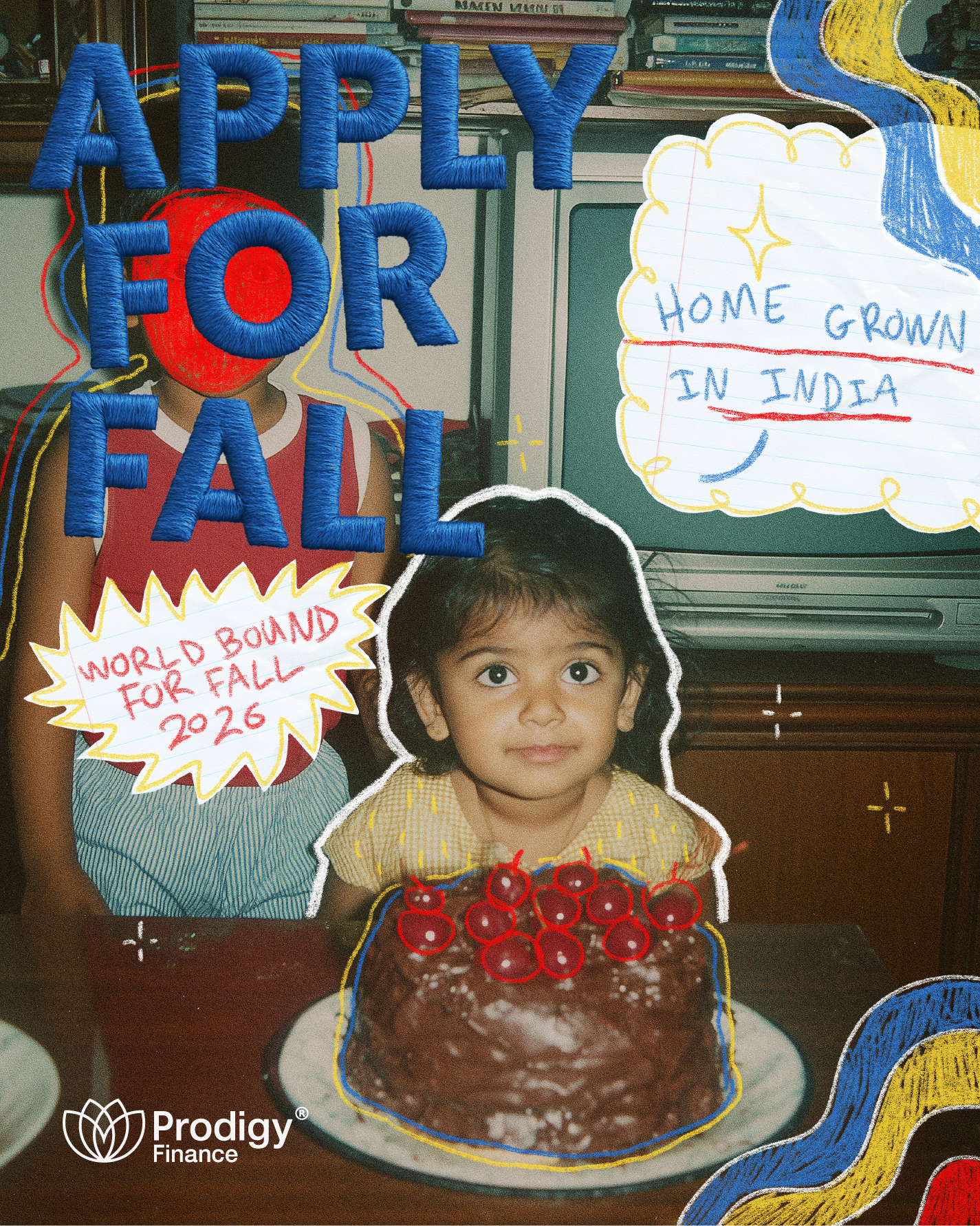

Master’s loans starting from 9.66%* interest rate

Student finance that gives you choice, control, and repayments based on your future earning potential

Check your master’s loan eligibility in seconds!

Our eligibility tool verifies a few core requirements, such as:

Is your university supported?

Is your study country support?

Are you from a supported country?

Discover your eligibility and get a quote now, even before program acceptance. We'll just need proof of admission when you're ready to complete your loan.

Finance your master’s abroad with a loan built for international students.

Check your eligibility, get a personalised offer, and move one step closer to campus.

Got questions about your application?

Book a focused 15-minute virtual session with our team and get guidance on your next steps.

Available from 2-4 PM , 8-10 PM (IST)

HOW TO APPLY

How do I apply online?

Apply for a student loan through Prodigy Finance and take the next step in your education journey.

Step 1: Apply online

Register an account, and submit your applications for any of our supported schools.

Step 2: Get your offer

You'll receive a non-binding provisional offer valid for 14 days.

Step 3: Document verification

Accept your offer and upload your supporting documents. If successfully verified, you'll be matched to available funding.

Step 4: Loan confirmation

Once your funding has been allocated, you'll need to accept the offer, and pay a USD 500 processing fee, to finalise your loan.

Our processing fee is the only upfront fee you are required to pay for your loan.

What happens after I’ve submitted my application?

Once you've arrived on campus and started your new journey, Prodigy Finance will assist you every step of the way. Here are the next steps to ensure a smooth transition:

Step 5: Complete final steps

Monitor your Prodigy dashboard and emails for any additional tasks needed before finalizing your loan agreement.

Step 6: Sign your loan agreement

Once you arrive on campus, you'll sign your loan agreement digitally. Funds are then sent directly to your school.

FAQ

Who is eligible for a Prodigy Finance student loan?

What are the loan repayment terms?

Can I apply without a co-signer or collateral ?

Can I repay my loan early?

When should I apply for the UK Student visa?

How early can I apply for a US student visa?

When can I apply for OPT?

What happens if my visa expires while I’m in the US?

When should I apply for a study permit in Canada.

Share your story

Already part of the Prodigy Finance alumni? Sharing your journey can truly inspire and guide students who are about to start their own paths.

)